Join Us in Celebrating Credit Union Youth Month

During the month of April, credit unions in Maine and across the country celebrate National Credit Union Youth Month and National Financial Literacy Month. While credit unions take financial education seriously all year long, this month provides us even more opportunities to work with our members and community partners to promote financial wellness.

To help your credit union tailor your efforts to younger members, we encourage you to join with our League in promoting the theme “Save Away for a Rainy Day” because when kids learn about the importance of saving money for the future, they are laying the foundation for financial success! To echo this concept in your activities, the League has created a number of materials for your credit union to use. The hashtag #CUYouthMonth also can be utilized on social media to demonstrate the power of our collaborative efforts.

Below are graphics and sample messaging that credit unions can share on their social media channels. The messaging can be edited and customized to reflect your credit union’s brand. Also included are coloring pages and a word search to help engage younger members.

While these materials have been created for Maine credit unions, other Leagues and their member credit unions may use these advocacy pieces in their outreach efforts. People Helping People and collaboration is what our movement is all about!

Post #1 – Help your children set savings goals.

Facebook, LinkedIn, and Instagram: Children––just like adults––will be much more motivated to save their money if they have a specific goal in mind. Help them set their sights on something to save up for, remind them of their goal whenever they get an inclination to spend, and watch them as they experience the thrill of achieving an accomplishment! #CUYouthMonth

X: Children are more motivated to save their money if they have a specific goal in mind. Help them set their sights on something to save up for, remind them of their goal when they get an inclination to spend, and watch as they experience the thrill accomplishment! #CUYouthMonth

Post #2 – Open a youth savings account at your local credit union.

Facebook, LinkedIn, and Instagram: With lower fees and higher savings rates, a youth savings account at your credit union can help kids lay the foundation for future financial success. #CUYouthMonth

X: With lower fees and higher savings rates, a youth savings account at your credit union can help kids lay the foundation for future financial success. #CUYouthMonth

Post #3 – Use a clear jar for saving money at home.

Facebook, LinkedIn, and Instagram: If you’re trying to communicate the importance of saving money at home, consider using a clear jar. While a piggy bank is a great idea, it doesn’t give kids a visual. When using a clear jar, they can see their money grow over time. Tell your children, “Once the money reaches the top, you can use that money to buy something you want.” They will be able to monitor their progress, experience delayed gratification, and learn the importance of saving. #CUYouthMonth

X: Use a clear jar for savings instead of a piggy bank at home. Tell your children, “Once the money reaches the top, you can use that money to buy something.” They will be able to monitor their progress, experience delayed gratification, and learn the importance of saving. #CUYouthMonth

Post #4 – Play money management games during CU Youth Month.

Facebook, LinkedIn, and Instagram: Board games like Monopoly or the Game of Life encourage kids to strategize––teaching them the importance of budgeting, saving, and planning for the future, all while masquerading as fun games. #CUYouthMonth

X: Board games like Monopoly or the Game of Life encourage kids to strategize—teaching them the importance of budgeting, saving, and planning for the future, all while masquerading as fun games. #CUYouthMonth

Post #5 – Consider matching your child’s savings as an incentive.

Facebook, LinkedIn, and Instagram: One of the reasons people save in their employer’s retirement plan is the company’s matching contribution. If you’re looking to motivate your children to save, consider using a similar method. If they’re saving for a particular item, such as a toy or video game, consider offering matches when they hit certain savings milestones. #CUYouthMonth

X: One of the reasons people save in their employer’s retirement plan is the company’s match. To motivate your children to save, use a similar method. If they’re saving for a particular item, consider offering matches when they hit certain savings milestones.

Post #6 – Save away for a rainy day at your local credit union.

Facebook, LinkedIn, and Instagram: Traditional savings accounts offer a tried-and-true way for people to store money. If you want to start saving for your child’s future, open a youth savings account at your local credit union! #CUYouthMonth

X: Traditional savings accounts offer a tried-and-true way for people to store money. If you want to start saving for your child’s future, open a youth savings account at your local credit union! #CUYouthMonth

Post #7 – Start saving for college now.

Facebook, LinkedIn, and Instagram: Maine’s Section 529 plan can help families save for higher education, with all earnings being tax-free! The earlier you start saving for your kids’ higher education, the more time it will have to compound and grow—giving your kids a head start in funding their future educational expenses. #CUYouthMonth

X: Maine’s Section 529 plan is tax-free and can help families save for higher education The earlier you start saving for your kids’ higher education, the more time it will have to compound and grow—giving your kids a head start in funding their future education. #CUYouthMonth

Post #8 – What did your children learn about savings this month?

Facebook, LinkedIn, and Instagram: What did your children learn about their credit union and the importance of savings this month? Let us know in the comments! #CUYouthMonth

X: What did your children learn about their credit union and the importance of savings this month? Let us know in a reply! #CUYouthMonth

– Poster

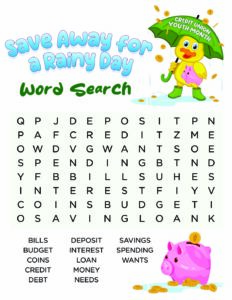

– Poster