Education Resources

Maine credit unions are dedicated to helping their members achieve their goals in regard to financial well-being. To support your credit union with its financial education outreach efforts, the League has compiled a list of valuable resources from both the League and its partners. Collateral is available for work with any age, spanning from kindergarten through adulthood. There is truly something for everybody! We can’t wait to see how your credit union utilizes the below resources to arm your members with financial wellness tools for a better future.

If you have any questions, please contact Jake Holmes, Director of Outreach & Strategic Planning, for guidance on financial education.

Assisting Maine Teachers

Assisting Maine Teachers

The Maine Credit Union League and Maine credit unions have long-been advocates of financial education, knowing the students of today will be the community leaders of tomorrow. As part of our efforts to promote and instill financial education, Maine credit unions provide support and resources to our state’s educators.

For more on the importance of financial literacy and how we can assist Maine teachers in delivering financial education, watch this video:

Credit Union Youth Month

Join Us in Celebrating Credit Union Youth Month

During the month of April, credit unions in Maine and across the country celebrate National Credit Union Youth Month and National Financial Literacy Month. While credit unions take financial education seriously all year long, this month provides us even more opportunities to work with our members and community partners to promote financial wellness.

To help your credit union tailor your efforts to younger members, we encourage you to join with our League in promoting the theme “A Sea of Savings” because when kids learn about the importance of saving money for the future, they are laying the foundation for financial success! To echo this concept in your activities, the League has created a number of materials for your credit union to use. The hashtag #CUYouthMonth also can be utilized on social media to demonstrate the power of our collaborative efforts.

Below are graphics and sample messaging that credit unions can share on their social media channels. The messaging can be edited and customized to reflect your credit union’s brand. Also included are coloring pages and a word search to help engage younger members.

While these materials have been created for Maine credit unions, other Leagues and their member credit unions may use these advocacy pieces in their outreach efforts. People Helping People and collaboration is what our movement is all about!

Post #1 – Help your children set savings goals.

Facebook, LinkedIn, and Instagram: Children––just like adults––will be much more motivated to save their money if they have a specific goal in mind. Help them set their sights on something to save up for, remind them of their goal whenever they get an inclination to spend, and watch them as they experience the thrill of achieving an accomplishment! #CUYouthMonth

X: Children are more motivated to save their money if they have a specific goal in mind. Help them set their sights on something to save up for, remind them of their goal when they get an inclination to spend, and watch as they experience the thrill accomplishment! #CUYouthMonth

Post #2 – Open a youth savings account at your local credit union.

Facebook, LinkedIn, and Instagram: With lower fees and higher savings rates, a youth savings account at your credit union can help kids lay the foundation for future financial success. #CUYouthMonth

X: With lower fees and higher savings rates, a youth savings account at your credit union can help kids lay the foundation for future financial success. #CUYouthMonth

Post #3 – Use a clear jar for saving money at home.

Facebook, LinkedIn, and Instagram: If you’re trying to communicate the importance of saving money at home, consider using a clear jar. While a piggy bank is a great idea, it doesn’t give kids a visual. When using a clear jar, they can see their money grow over time. Tell your children, “Once the money reaches the top, you can use that money to buy something you want.” They will be able to monitor their progress, experience delayed gratification, and learn the importance of saving. #CUYouthMonth

X: Use a clear jar for savings instead of a piggy bank at home. Tell your children, “Once the money reaches the top, you can use that money to buy something.” They will be able to monitor their progress, experience delayed gratification, and learn the importance of saving. #CUYouthMonth

Post #4 – Play money management games during CU Youth Month.

Facebook, LinkedIn, and Instagram: Board games like Monopoly or the Game of Life encourage kids to strategize––teaching them the importance of budgeting, saving, and planning for the future, all while masquerading as fun games. #CUYouthMonth

X: Board games like Monopoly or the Game of Life encourage kids to strategize—teaching them the importance of budgeting, saving, and planning for the future, all while masquerading as fun games. #CUYouthMonth

Post #5 – Consider matching your child’s savings as an incentive.

Facebook, LinkedIn, and Instagram: One of the reasons people save in their employer’s retirement plan is the company’s matching contribution. If you’re looking to motivate your children to save, consider using a similar method. If they’re saving for a particular item, such as a toy or video game, consider offering matches when they hit certain savings milestones. #CUYouthMonth

X: One of the reasons people save in their employer’s retirement plan is the company’s match. To motivate your children to save, use a similar method. If they’re saving for a particular item, consider offering matches when they hit certain savings milestones.

Post #6 – Save away for a rainy day at your local credit union.

Facebook, LinkedIn, and Instagram: Traditional savings accounts offer a tried-and-true way for people to store money. If you want to start saving for your child’s future, open a youth savings account at your local credit union! #CUYouthMonth

X: Traditional savings accounts offer a tried-and-true way for people to store money. If you want to start saving for your child’s future, open a youth savings account at your local credit union! #CUYouthMonth

Post #7 – Start saving for college now.

Facebook, LinkedIn, and Instagram: Maine’s Section 529 plan can help families save for higher education, with all earnings being tax-free! The earlier you start saving for your kids’ higher education, the more time it will have to compound and grow—giving your kids a head start in funding their future educational expenses. #CUYouthMonth

X: Maine’s Section 529 plan is tax-free and can help families save for higher education The earlier you start saving for your kids’ higher education, the more time it will have to compound and grow—giving your kids a head start in funding their future education. #CUYouthMonth

Post #8 – What did your children learn about savings this month?

Facebook, LinkedIn, and Instagram: What did your children learn about their credit union and the importance of savings this month? Let us know in the comments! #CUYouthMonth

X: What did your children learn about their credit union and the importance of savings this month? Let us know in a reply! #CUYouthMonth

– Coloring Page

– Word Search

– Crossword Puzzle

– Poster

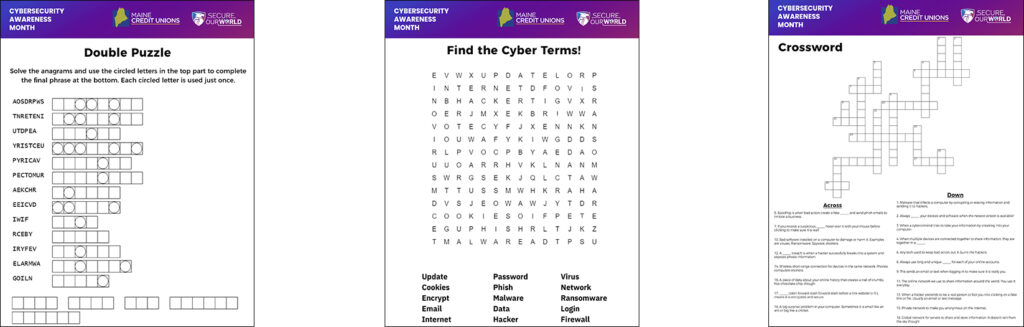

Cybersecurity Awareness Month

Promote These Resources Throughout Cybersecurity Awareness Month

This October, our League hopes you will join us in recognizing Cybersecurity Awareness Month—a time to bring attention to online threats, as well as the steps people can take to better protect themselves when using the internet. Fraudsters and scammers are ever-evolving and deceptively clever in their attempts to obtain your members’ money and personal information. To help members avoid falling victim, credit unions are encouraged to remind them about four simple steps they can take to increase their online security:

- Enable Multi-Factor Authentication

- Use Strong Passwords

- Recognize and Report Phishing

- Update Your Software

Promote these steps by posting turnkey social media posts, sharing the blog, exhibiting materials in your lobbies, and offering educational games and puzzles to members––all of which can be found below:

Access the Cybersecurity Awareness Month blog here.

Social Media Assets

Below, please find sample social media messages that can be customized and shared to help your members learn more about cybersecurity. The League also has created graphics that can be downloaded and promoted on Facebook, LinkedIn, X, and Instagram. Please remember to use the hashtags #CyberSafe and #SecureOurWorld.

Download the social media graphics here.

Week 1 Sample Messaging – Enable Multi-Factor Authentication

- For maximum protection, use multi-factor authentication everywhere it’s an option. While no security method is entirely foolproof, two-factor authentication makes it more difficult for fraudsters to steal personal information or access accounts. #CyberSafe #SecureOurWorld

- Multi-factor authentication adds a layer to your cybersecurity by requiring you to validate your identity with multiple verification processes, including answering security questions, verifying a code sent to your mobile phone, or scanning your fingerprint. #CyberSafe #SecureOurWorld

Week 2 Sample Messaging – Use Strong Passwords

- A leading cause of unauthorized access to accounts is the reuse of login credentials. If you use the same password for every account you have, a single account breach can grant a fraudster access to all of them. Instead, create unique passwords for each login. #CyberSafe #SecureOurWorld

- Avoid including personal information in your passwords. Names, birthdays, anniversaries, and other easily guessable information should never be used. #CyberSafe #SecureOurWorld

Week 3 Sample Messaging – Recognize and Report Phishing

- If you see an individual or group trying to solicit passwords, Social Security numbers, credit card numbers, or other sensitive information from you or someone else, report it at www.cisa.gov/report. #CyberSafe #SecureOurWorld

- If you receive an email that threatens a consequence or opportunity loss unless urgent action is taken, it’s likely a scam! This approach is used to rush you into action before you have an opportunity to study the email for potential flaws or inconsistencies. #CyberSafe #SecureOurWorld

Week 4 Sample Messaging – Update Your Software

- Fraudsters are always looking to exploit flaws in your system. Network defenders are working hard to fix them as soon as they can, but their work relies on all of us updating our software with their latest fixes. Update your software regularly. #CyberSafe #SecureOurWorld

- Update the operating system on your mobile phones, tablets, and laptops. Update the apps on all your devices too. Turn on automatic updates for all devices, applications, and operating systems to limit exploitation opportunities for fraud #CyberSafe #SecureOurWorld

Download the poster, double puzzle, crossword puzzle, and word search here.

If you need additional assistance promoting Cybersecurity Awareness Month at your credit union, or if you have any difficulty downloading the graphics, please email Jake Holmes, the League’s Director of Outreach & Financial Education, at jholmes@mainecul.org.

World Elder Abuse Awareness Day

Join the League in Preventing Scams This World Elder Abuse Awareness Day!

Here in the U.S., financial exploitation is the fastest-growing form of elder abuse. Elder financial exploitation is defined as the illegal or improper use of an elder’s funds, property, or assets. According to the NCUA, up to five million older Americans are abused each year, with annual losses estimated to total $28.3 billion. Given that Maine has the oldest population in the nation, it is more important than ever to raise awareness about this issue here in the Pine Tree State.

June 15 is World Elder Abuse Awareness Day (WEAAD) and provides our League and credit unions with a forum to amplify our voices––allowing us to reach a larger audience with the elder financial abuse prevention messaging and resources we provide year-round.

To help your credit unions educate members on this topic, the League has written a blog on the red flags of elder financial abuse, as well as how individuals can prevent or respond to abuse. The League also developed social media graphics and messaging for Facebook and Instagram––both of which can be repurposed and shared on any platform.

- Facebook/LinkedIn: June 15 is World Elder Abuse Awareness Day. An estimated 5 million, or 1 in 10, older Americans experience elder abuse or exploitation each year—many through financial scams. Learn more about how you can help the older Mainers in your life identify and avoid falling victim to elder financial abuse by reading this blog. (insert blog link) #WEAAD

- Instagram: June 15 is World Elder Abuse Awareness Day. An estimated 5 million, or 1 in 10, older Americans experience elder abuse or exploitation each year—many through financial scams. Join (credit union name) in taking a stand against elder abuse! #WEAAD

Please click here to download the social media graphics.

As credit union representatives, we are uniquely positioned to educate our communities about fraud and scams. We interact with members every day, whether face-to-face or via digital channels, and we see the hardships scams cause our neighbors. We hope you’ll join the League in our efforts to thwart the top scams targeting seniors this World Elder Abuse Awareness Day.

Lastly, it’s important to remember fraudsters and scammers are ever evolving, deceptively clever, and relentless in their attempts to obtain peoples’ money and personal information––meaning spreading awareness and educating members about scams are important efforts every day. To stay up-to-date on all the latest fraud prevention information, tips, and resources, visit the League’s Fraud Prevention Resources page.

If you have any questions about World Elder Abuse Awareness Day or our general fraud prevention efforts, contact Jake Holmes, the League’s Director of Outreach & Strategic Planning.

Adult Resources

Because financial education isn’t just for youth, Maine credit unions are active in helping adults with budgeting, first-time home buying, retirement, and more.

For All Adults

- hoMEworks (A nonprofit group dedicated to consumer homebuyer education. hoMEworks believes the best place to start the home buying process is in the classroom.)

- ProsperityME (Information and resources for New Mainers/immigrants)

- United Way of Greater Portland CA$H Coalition

- AARP Tax-Aide

- To check your credit score, please visit:

- Maine credit unions also have access to a brand-new adult education curriculum, which includes grab-and-go resources and a lesson plan that credit union staff or volunteers can bring to food pantries, rotary clubs, and other community organizations.

For Seniors

AARP Money Management Program

Do you or someone you know need help? In partnership with AARP, this program offers money management services to individuals with lower incomes. Seniors and people with disabilities work with trained, bonded volunteers to help balance their checkbooks, write checks for signing, organize their mail, and/or develop a budget. Participants sign their own checks and retain full control of their bank accounts and other assets.

Find a program in your area:

Spectrum Generations

Kennebec, Knox, Somerset, and Waldo Counties

Eastern Area Agency on Aging

Penobscot, Piscataquis, Hancock, and Washington Counties

Aroostook Agency on Aging

Aroostook County

Southern Maine Agency on Aging

York and Cumberland Counties

SeniorsPlus

Androscoggin, Franklin, and Oxford Counties

Youth Resources

There are a number of resources available for parents and children to learn more about money management and personal finance. Many of the links below are partners of the League and Maine’s credit unions. Click on any of the links below to get started.

- Maine Credit Unions’ Financial Fitness Fairs – Since the program’s inception in 2004, approximately 80,000 Maine students have participated in a Financial Fitness Fair.

- The Maine Credit Union League is an eighteen-time winner of the national Desjardins Award for Youth Financial Education.

- Maine credit unions have a dedicated Director of Outreach & Strategic Planning to help Mainers with financial education, challenges, and opportunities.

- Maine credit unions have access to elementary and middle school-level curriculum programs, which consists of grab-and-go resources and lesson plans that credit union staff or volunteers can lead in schools.

- Maine Credit Unions’ Financial Literacy Blog

- Maine Credit Unions’ Virtual Financial Fitness Fair

- Maine Credit Unions’ Curriculum

- Maine Jump$tart Coalition

- National Endowment for Financial Education (NEFE)

- Next Gen Personal Finance

- Junior Achievement of Maine