(From Callahan & Associates – May 26) – Credit union membership experienced significant growth in the last calendar year. With over 4.8 million new members, the credit union industry saw a membership 12-month growth rate of 3.8%, slightly ahead of the 12-month growth rate this time last year. Callahan & Associates shared industry data from the first quarter of 2022 last week during its quarterly Trendwatch webinar.

“Members are why credit unions exist,” said Callahan’s Chief Collaboration Officer and President of Financial Services Jay Johnson.

During an inflationary period, credit unions are searching for ways to strengthen the member relationship. Amplify Credit Union ($1.3B, Austin, TX) has placed an emphasis on this approach. Kendall Garrison, CEO of Amplify Credit Union, promoted the business case for fee-free consumer deposits.

“It’s not about giving back,” said Garrison. “It’s about not taking in the first place.”

Annual Loans Growing At Fastest Rate In 17 Years

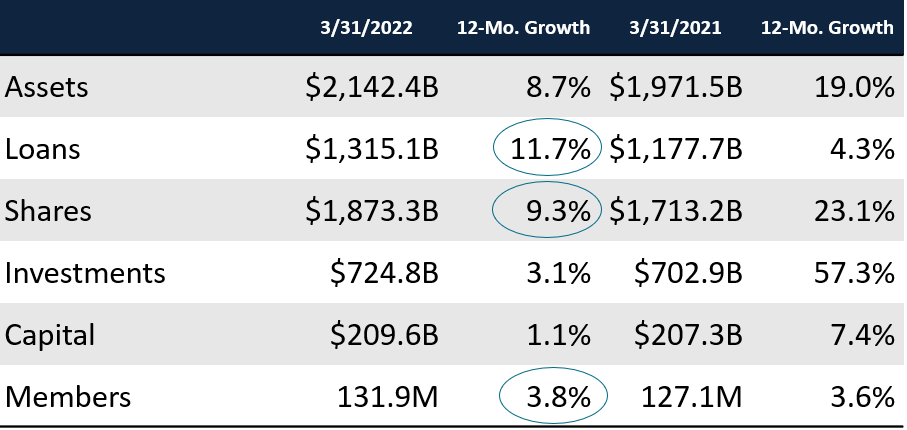

For the first time since 2019, the rate at which annual loans have grown has outpaced the growth of shares. Loan growth rose to 11.7%, up over 7% from last year’s growth. The loan portfolio is currently growing at the fastest annual rate since 2005. Share growth slowed to 9.3%, down from the extraordinary 23.1% growth rate seen in the prior year.

Credit unions are also keeping more loans on their balance sheet. Members are paying down loans at a slower rate and credit unions are not as quick to sell loans to the secondary market.

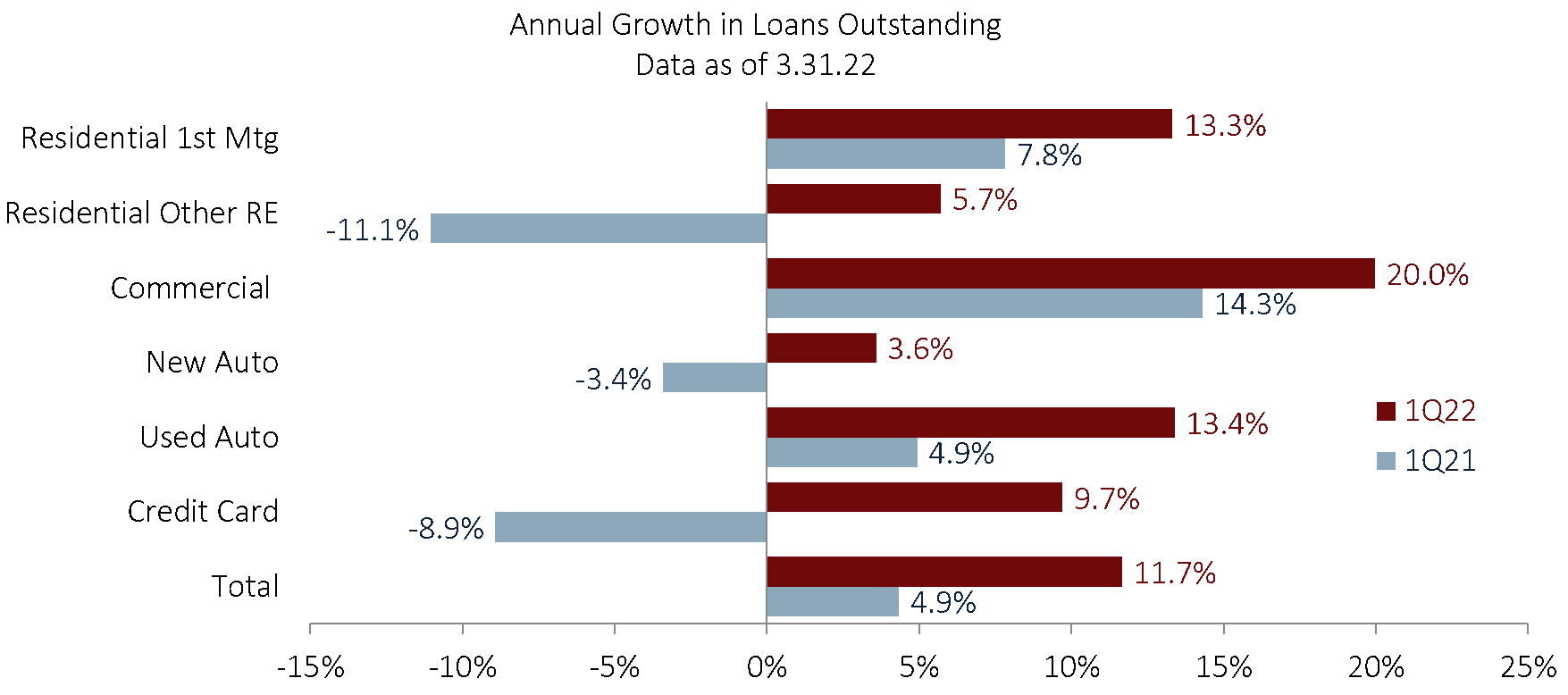

Consumer Loan Originations Up Significantly

Consumers and small businesses continued to turn to credit unions during the first quarter of 2022. Non-real estate consumer loan originations are up 11% from the year prior, while commercial loan growth is up 20%. These trends signify the increasing impact that credit unions have for the small businesses within their community.

Lake Trust Credit Union was highlighted during the event as an example of a cooperative who is prioritizing the needs of small businesses. Lake Trust launch their microlending program in 2019 and, since it’s launch, has made more than 230 microloans that have directed more than $5.5 million to local businesses.

Lake Trust was recently featured on CreditUnions.com, as we highlighted their partnership with an economic development group in Lansing, Michigan to create an incubator for local startups.

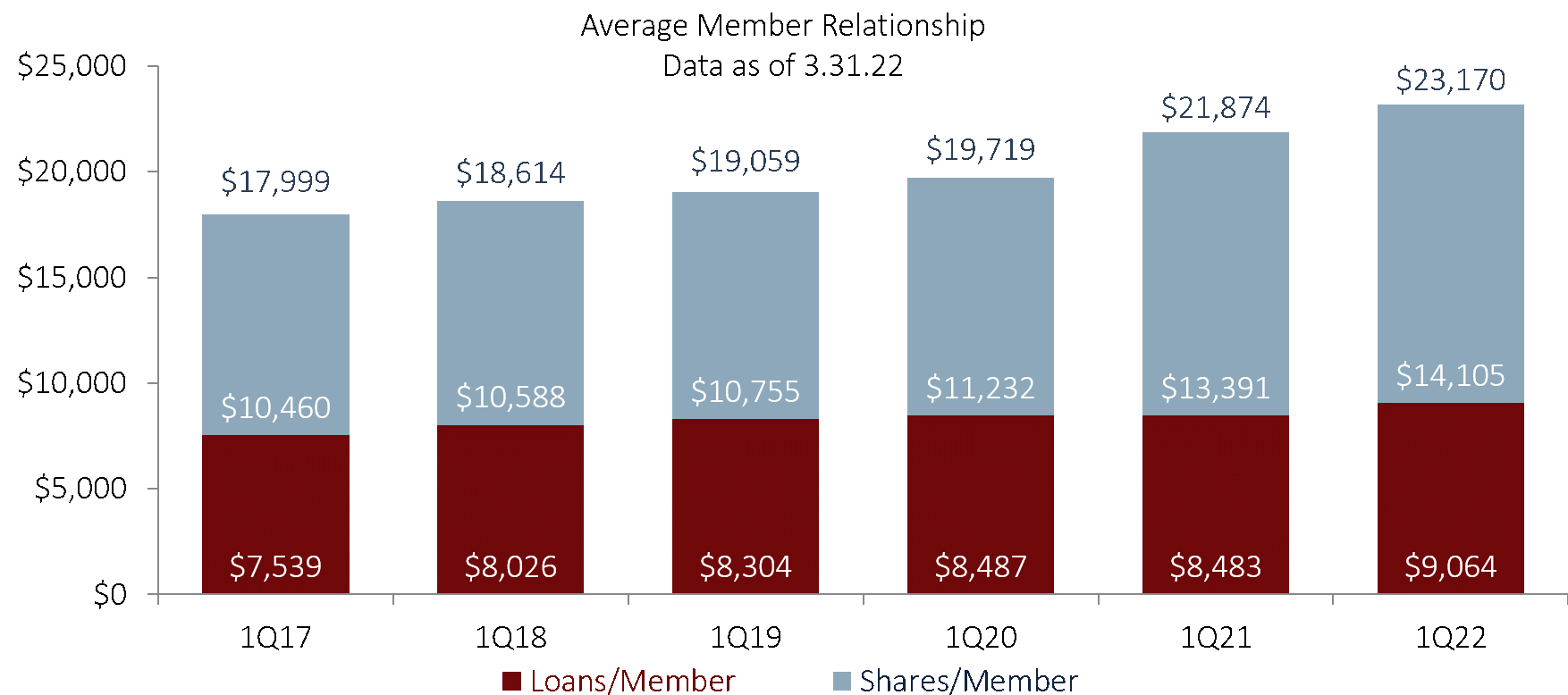

Average Member Relationship Continues To Grow

In a trend that has continued for the better part of a decade, the average loans per member and shares per member rose once more. Thus, the average member relationship grew by $1,296 from 1Q21 to 1Q22.

The increased growth in this category highlights the bonds between credit unions and their members. The ACT Model was referenced in regard to this metric. The ACT Model empowers credit unions to respond to member needs by Acknowledging their concerns, Confirming their needs, and Taking action.

For more industry data, read Callahan’s 5 Takeaways From Trendwatch or watch the webinar recording on CreditUnions.com.

Callahan credit union clients can access industry data via Peer-to-Peer, CUAnalyzer, and Peer+ on their client portal. Non-clients can request a custom data scorecard here.

About Callahan & Associates

For more than 35 years, Callahan & Associates has helped credit union leaders identify strategic growth opportunities that increase member value. We create meaningful dialogue, connect people, provide counsel, and help organizations thrive through our competitive analytics, best-practice media, leadership consulting, and collaborative ventures. Our clients grow assets, members, shares, and loans faster than industry averages. Learn more at www.callahan.com.