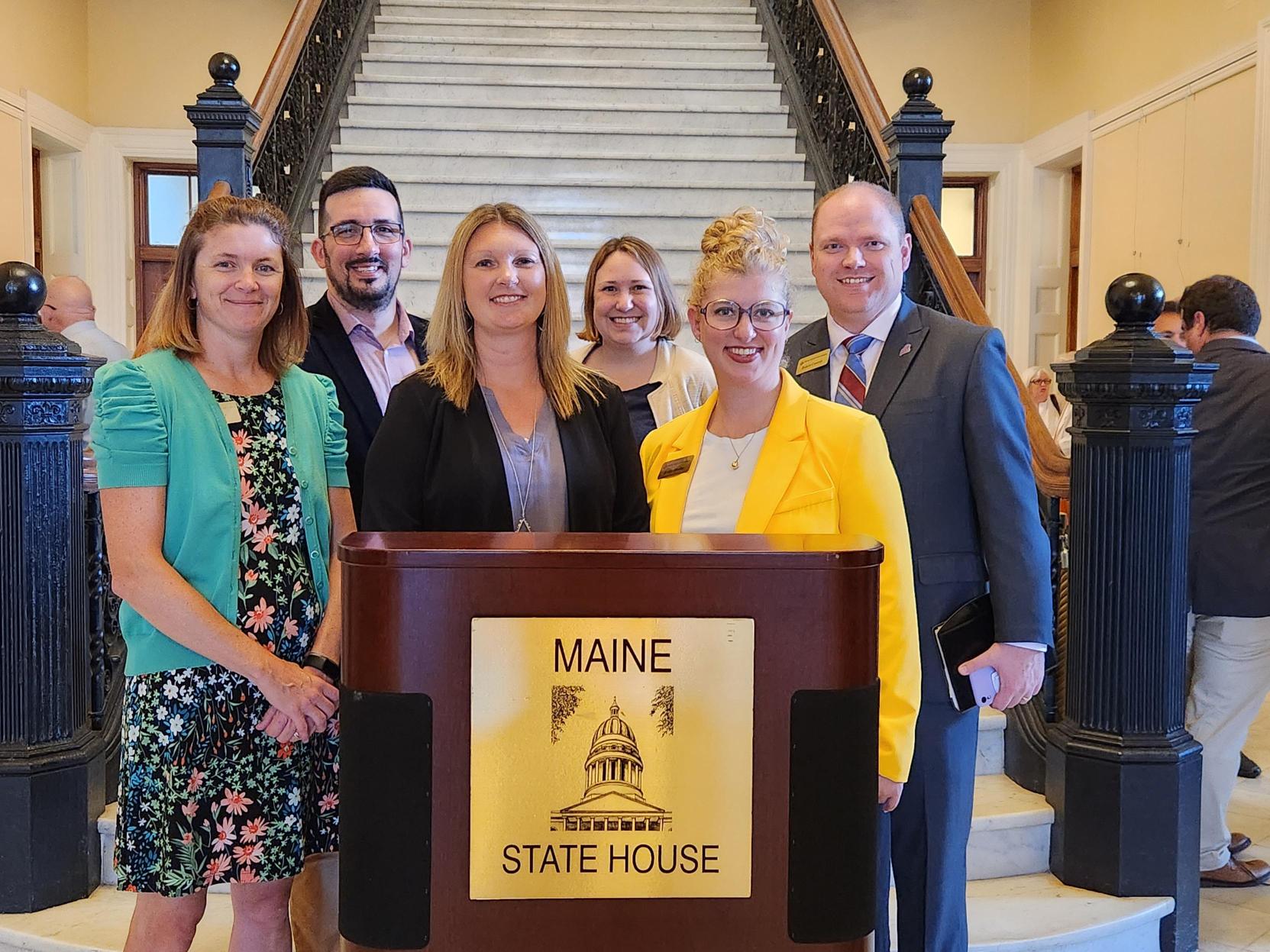

From left to right: Betsy Sibley (Community CU); Nick Tammaro (MECUL); Jen Hogan (Community CU); Ellen Parent; Krista Simonis; and Robert Caverly (MECUL).

On Tuesday, the League joined Governor Mills, Senator Peggy Rotundo, Community CU, and the Bureau of Financial Institutions at a bill signing ceremony to commemorate the enactment of LD 1277, An Act to Amend the Laws Regarding Real Property Investment by Credit Unions. The bill authorizes credit unions to invest in property for a limited period of time to facilitate a member’s acquisition, financing, or refinancing of an owner-occupied residential property. It was introduced to help meet the needs of Maine’s growing Muslim community.

“Credit unions were created to help the underserved meet their financial needs,” shared Robert Caverly, League Vice President of Advocacy & Outreach. “Thanks to the leadership of Senator Rotundo, Governor Mills, and the entire Maine legislature, we’re proud to see these efforts continue. The Bureau of Financial Institutions’ willingness to innovate with credit union leaders like Jen Hogan means we are now one step closer to offering interest-free loan products to Muslim communities in Maine.”

With the Governor’s signature, the bill goes into effect 90 days after the conclusion of this legislative session, which ended July 25. The League is working in partnership with Community CU and the Bureau to finalize the loan program details.

“This is a project I’ve been working on for more than five years, and I’m grateful to Senator Rotundo and Governor Mills for their shared commitment to the Muslim community,” stated Jen Hogan, President/CEO at Community CU. “Our credit union prides itself on finding ways to provide financial wellbeing and financial equity for everyone and this change in law will enable us to implement a new program that provides our Muslim community the opportunity to realize the American dream of home ownership without sacrificing their personal beliefs. I look forward to the day when we can say that we have closed on the first interest-free mortgage in Maine.”