Fraudsters and scammers are ever-evolving and deceptively clever in their attempts to obtain members’ money and personal information. For many tellers and frontline staff, this means their roles have had to shift beyond the administration of cash handling and account management. Nowadays, tellers are playing an increasingly important role in safeguarding members from fraud and scams. Often, they are the first line of defense—having direct, face-to-face interaction with members daily. And with access to real-time transaction data, they can quickly identify suspicious patterns or irregularities in members’ account activities.

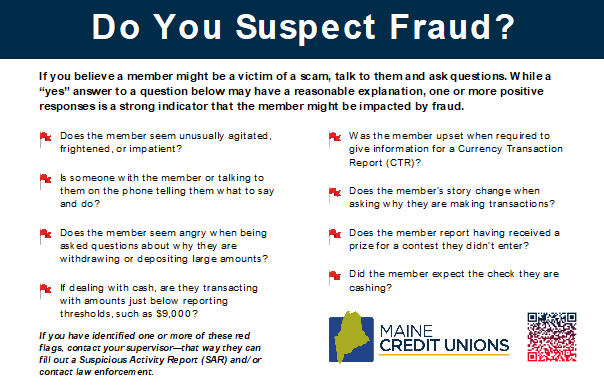

To help frontline staff better spot the red flags of fraud and scams, the League has developed a display for tellers to reference when interacting with members. The display prompts the tellers with questions they can ask if they feel something is unusual or suspicious, such as: Is someone with the member or talking to them on the phone, telling them what to say and do?

To download the display, click here.

A “yes” answer to one or more of the questions outlined is a strong indicator that the member may be impacted by fraud or a scam. If that is the case, the display encourages the teller to contact their supervisor to complete a Suspicious Activity Report (SAR) and/or contact law enforcement.

Additionally, the display has a QR code that will take frontline staff to the League’s Fraud Prevention Center, where they’ll find fraud prevention resources, talking points, industry resources, and more.

We hope your credit union will utilize the teller station display in your branch(es). By remaining vigilant and staying up-to-date on common red flags, we can help safeguard credit union members from falling victim to fraud and scams.