Emotions play a huge role in shaping member experience. Emotions influence members’ desire to buy or not to buy, what they remember and share about their experiences, and, most importantly, whether they will be loyal to your credit union.

To better understand how emotions shape member perceptions of their credit unions, CUNA Mutual conducted research earlier this year that examined emotions at two different levels:

- Anxiety related to consumers’ overall financial situation.

- Emotions arising from specific episodes consumers have while using different financial products and services.

This article shares a few highlights from this new study.

New Insights About Financial Anxiety

Unsurprisingly, many research firms, such as JD Power, Gallup, and Kantar, have tracked an increase in consumers’ anxiety, worry, and stress since the beginning of the pandemic. Our research also picked up on this rise in anxiety. Rising financial anxiety has important implications for financial institutions:

- Consumers who are anxious about their current financial situation tend to give their primary financial institutions significantly lower customer loyalty ratings.

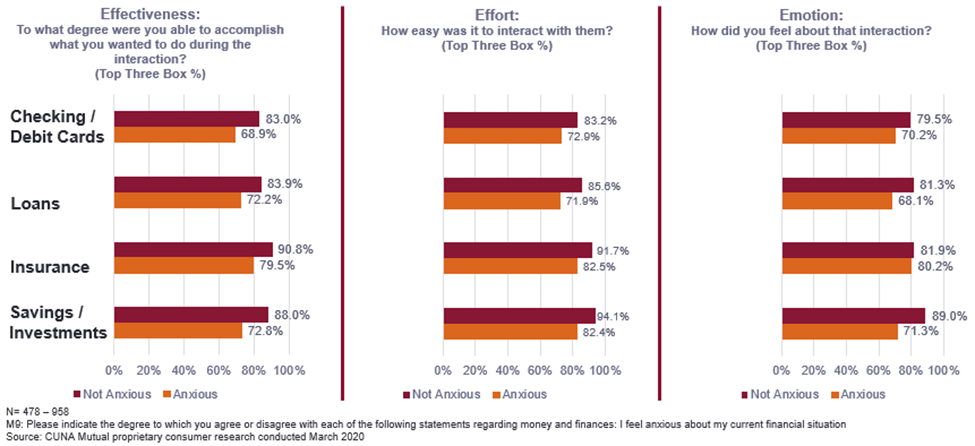

- Consumers experiencing financial anxiety tend to give lower customer experience (CX) ratings to their most recent interactions with their checking account / debit card, loans, insurance policies, and savings/investment products (see Figure 1).

While it’s unfortunate that some consumers are experiencing elevated levels of financial anxiety, it also represents a tremendous opportunity. Credit unions can use moments like these to turn anxiety-provoking situations into positive emotional experiences for their members.

While it’s unfortunate that some consumers are experiencing elevated levels of financial anxiety, it also represents a tremendous opportunity. Credit unions can use moments like these to turn anxiety-provoking situations into positive emotional experiences for their members.

To do that, credit unions will need to identify members who may be experiencing financial anxiety. Data and analytics could be used to flag individuals who may be experiencing financial anxiety, e.g., members with frequent overdrafts, chronic low balances, or delinquent loans. Once these members are identified, credit unions can then decide what help or relief, if any, should be extended to help alleviate these members’ financial anxiety.

Emotions Arising from Using Checking Accounts / Debit Cards

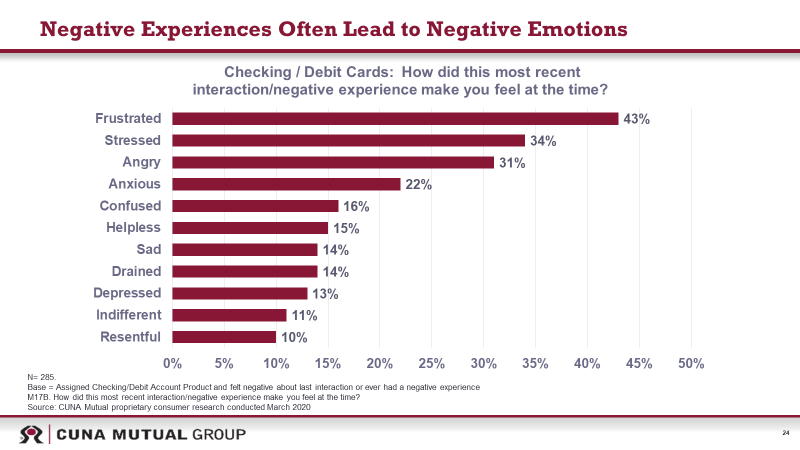

This year’s research examined the role of emotions stemming from specific episodes using various financial products and services, including checking accounts and debit cards. Negative experiences using these products can elicit strong negative emotions, including frustration, stress, and anger (see Figure 2).

Fortunately, this year’s research found that credit union members whose primary checking account or debit card is from their credit union have fewer negative experiences than consumers whose primary checking account or debit card is not provided by a credit union. Only 26 percent of credit union members whose primary checking account or debit card is from their credit union had a negative experience. By contrast, 44 percent of consumers whose primary checking account or debit card is not provided by a credit union had a negative experience.

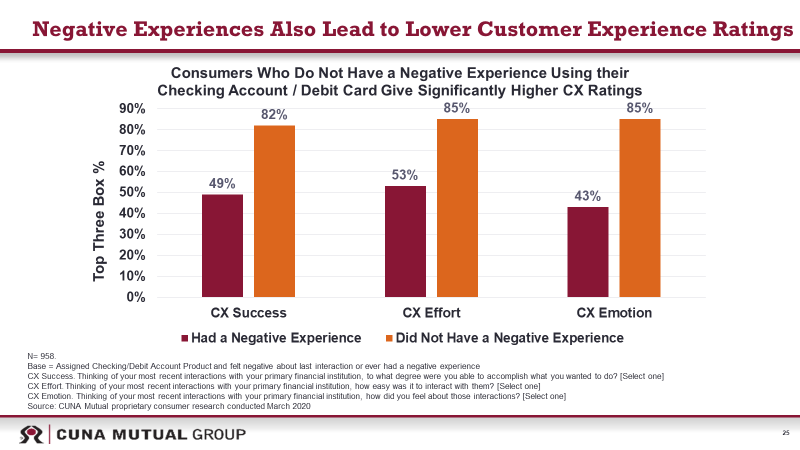

When consumers did have a negative experience, we saw that the rise in their negative emotions was accompanied by CX ratings that were 30+ percentage points lower than those of consumers who did not have a negative experience (see Figure 3).

Our research revealed four broad categories which captured most of the negative experiences reported by consumers:

- Customer service

- Product functionality (something about checking account / debit card didn’t work as expected)

- Fraud

- Fees

Credit unions seeking to reduce the incidence of negative experiences using their checking accounts and debit cards will need to determine the specific causes of these negative encounters. Once these are identified, credit unions can use member input, e.g., member interviews, focus groups, co-creation programs, to re-engineer member journeys in a way that delivers a positive emotional experience.

As we’ve just seen, emotions play an important role in what members think of your credit union and the experience you deliver. Focusing on functional aspects of your member experience, such as speed or efficiency, is not enough to guarantee a great experience. A truly excellent member experience requires following Dale Carnegie’s sage advice, “When dealing with people, remember you are not dealing with creatures of logic, but creatures of emotion.”

To read more about this research and a range of topics related to the emotional experience of members, visit our website.

About the Author

Steve Heusuk is the Senior Manager, Competitive & Market Intelligence, for CUNA Mutual Group.